Recently attended RCGP and now looking for a new professional indemnity quotation?

We can help...

MDDUS has been providing support and indemnity to medical and dental professionals for over 120 years. We pride ourselves on offering a quality, personalised service provided by our team of medico- and dento-legal advisers who are recognised as some of the leading UK experts in their field.

As a mutual organisation, one of the most valuable benefits of membership is that MDDUS doesn't have shareholders and does not pay dividends to its members. That means all the income generated by subscriptions is invested back into the organisation and member services, and in the maintenance of a healthy reserve to cover legal costs and claims.

Get a quote

Five reasons to

choose MDDUS

- Choice of discretionary indemnity or contractual insurance

- Choice of individual or centralised billing

- Discounted individual membership

- No annual fee for group medical scheme

- Expertise

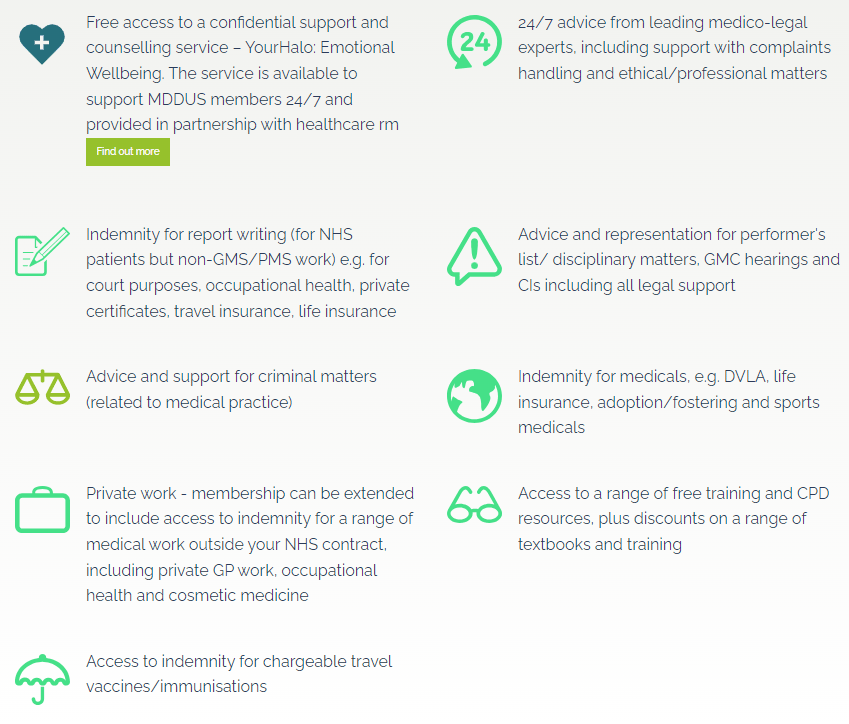

Standard Features and Benefits

GPs in England and Wales

Membership is available to NHS GPs in England and Wales. This offers advice and support on all medico-legal matters not covered by state-backed indemnity schemes, CNSGP/GMPI. The Clinical Negligence Scheme for General Practice in England (CNSGP) and the General Medical Practice Indemnity scheme in Wales (GMPI) are not comprehensive - they cover NHS clinical negligence claims but nothing else. MDDUS' General Practice Protection membership provides GPs working within the NHS in England and Wales with the above range of essential benefits.

Get a quoteGP Group Scheme for England and Wales

A range of benefits are available to GPs working in a practice where the majority are MDDUS members. The Clinical Negligence Scheme for General Practice in England (CNSGP) and General Medical Practice Indemnity in Wales (GMPI) are not comprehensive - they cover NHS clinical negligence claims but nothing else. In England and Wales, practices whose GPs have secured MDDUS' General Practice Protection (GPP) membership, the Group Scheme provides the above range of benefits.

Get a quoteGPs in Scotland and the rest of the UK

Our GP members in Scotland, Northern Ireland, Isle of Man and Channel Islands trust us to provide 24/7 advice and access to professional indemnity, support and guidance from our expert medico-legal teams. As a GP, you have a legal and ethical obligation to ensure you have appropriate, lifetime indemnity for your professional practice. MDDUS members have access to that indemnity, and enjoy a range of additional benefits, all at competitive rates

Get a quoteGP Discount Practice Scheme for Scotland and the rest of the UK

We offer discounted rates to full-time GPs working in a practice where the majority are MDDUS members, along with the above range of enhanced benefits. The Discount Practice Scheme (DPS) provides access to indemnity for vicarious liability for support staff, including practice nurses, managers and non-clinical staff. This extends to nurse practitioners and advanced nurse practitioners in Scotland, Northern Ireland, Isle of Man and Channel Islands.

Get a quoteIndemnity for medical groups and businesses

Looking for protection for a group of medics or your medical business?

With MDDUS Solutions, you can choose between discretionary, occurrence-based indemnity or claims-made insurance.

Why over 56,000 clinicians chose us...

Peer-to-peer

When you need expert support from MDDUS, you’re talking doctor-to-doctor. That’s a weight off your mind.

24/7 support

We’re alway here for you. Should you have an urgent medico-dento-legal issue, you can contact our team of professionals 24/7 and 365 days a year.

120 years of trust

Founded by clinicians for clinicians, we have over 120 years of experience and expertise in protecting our members against medical malpractice.

Training and CPD

Ensure your medical team has access to the professional development and accredited online learning resources they need.

Group savings

Save money, time and effort. It’s easier and cheaper to arrange medical cover for a group of medical professionals than doing it all yourselves.

Not-for-profit

We are a mutual organisation. For over 120 years, we’ve gained financial strength by operating for the benefit of our members, not by paying profits to shareholders.

OUR ‘NOT-FOR-PROFIT’ ETHOS

Our ethos is to provide insurance products which stay true to our mutual “not-for-profit” status.

Unlike most MDOs, we have an in-house underwriting team which gives us the autonomy to make our own decisions and continue to put the needs of our members before profit.